Have A Tips About How To Apply For A Mortgage Modification

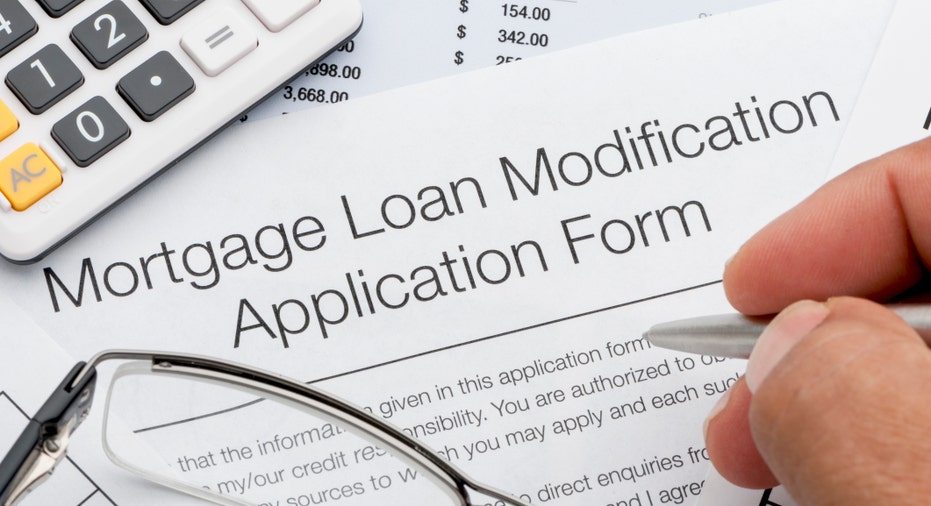

Keys to getting approved for a loan modification pay attention to details.

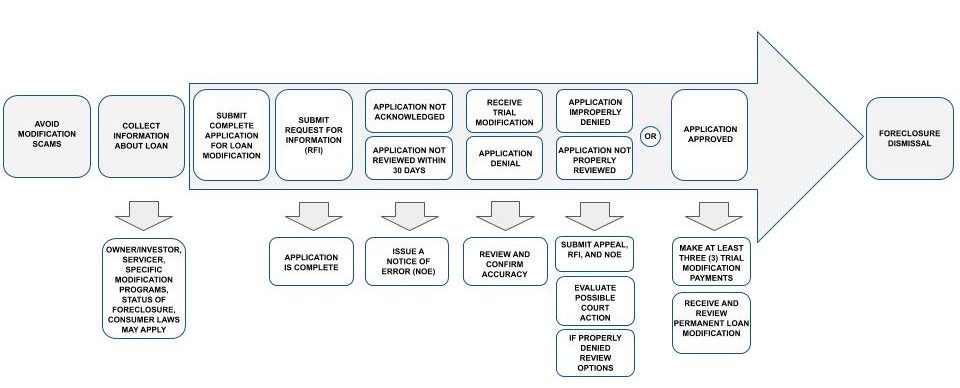

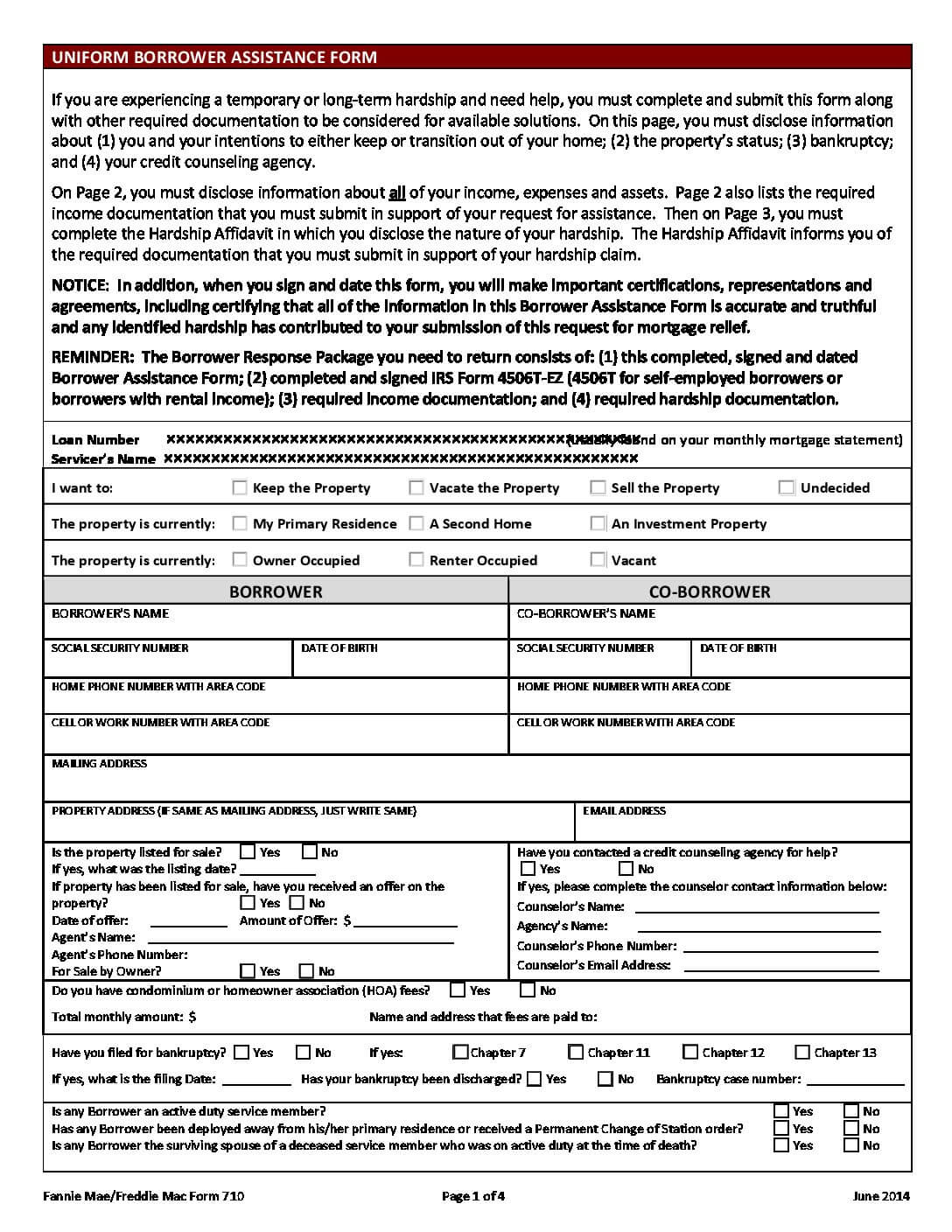

How to apply for a mortgage modification. Some require proof of hardship, and others require a hardship letter explaining why you need the modification. Also, you have to produce significant proof of expenses and income after and before the starting of your. Let's clarify more about mortgage loan modification procedure.

Complete the loss mitigation application as soon as possible. How to apply for a flex modification. Your income and expenditures will be required by your lender.

You’ll need to provide federal tax returns for the past two years as part of your financial picture. You’ll want to have proof of. Up to 25% cash back because your actions can be vitally important in getting your loan modified, it's essential that you to learn the do's and don'ts of the process.

Modification terms will be determined based on a review of your financial information provided by you in your complete application for homeowners' assistance. Be at least one regular payment behind or show that you’ll miss one very soon. With this plan, you can be able to modify the components of your.

Eligibility for a mortgage loan modification varies from lender to lender, but usually, you must: The loan modification application process varies from lender to lender; Up to 25% cash back how to apply for a loan modification.

Your lender will need information on your income and expenses. The first thing you should do after determining whether you have a mortgage owned by fannie mae or freddie mac is to reach out. To get a loan modification, you have to send your servicer a complete “loss mitigation” application.