Impressive Info About How To Become Financially Independent From Parents

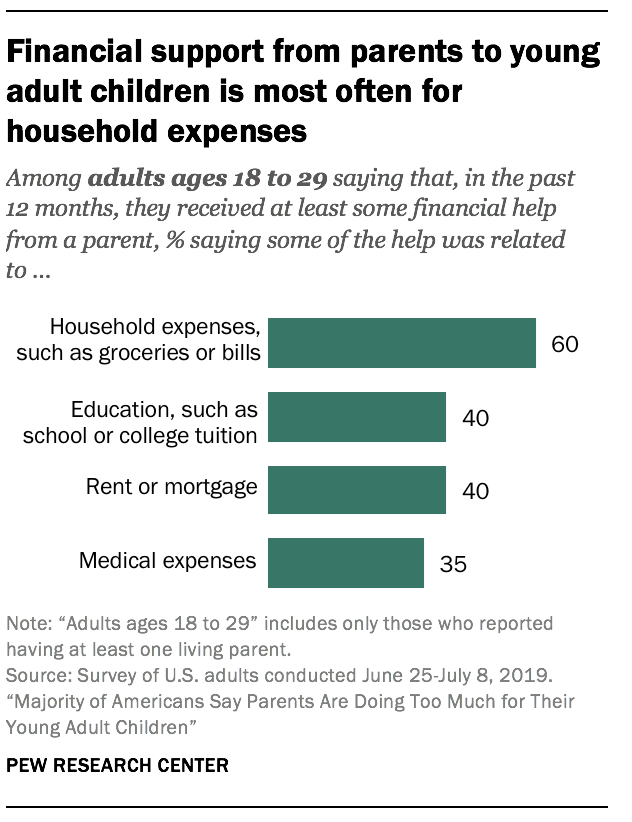

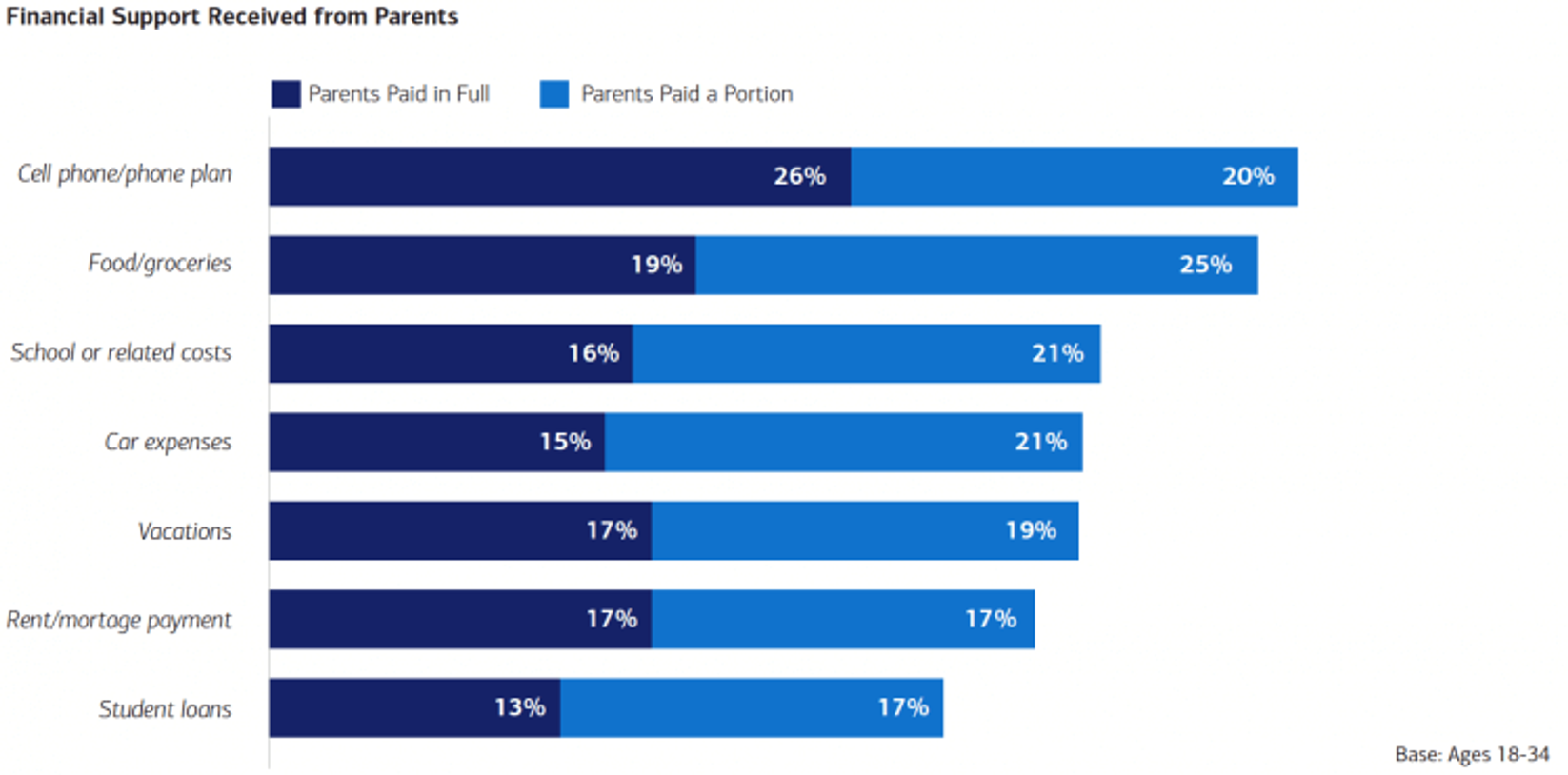

Cut back your expenses from getting a prepaid cell phone service to learning to cook instead of eating out, there are many small steps you can take now toward becoming more financially.

How to become financially independent from parents. The following are the steps to finally ditching your parents: Create and stick to a budget. 8 ways to become financially indepentent sooner | chime.

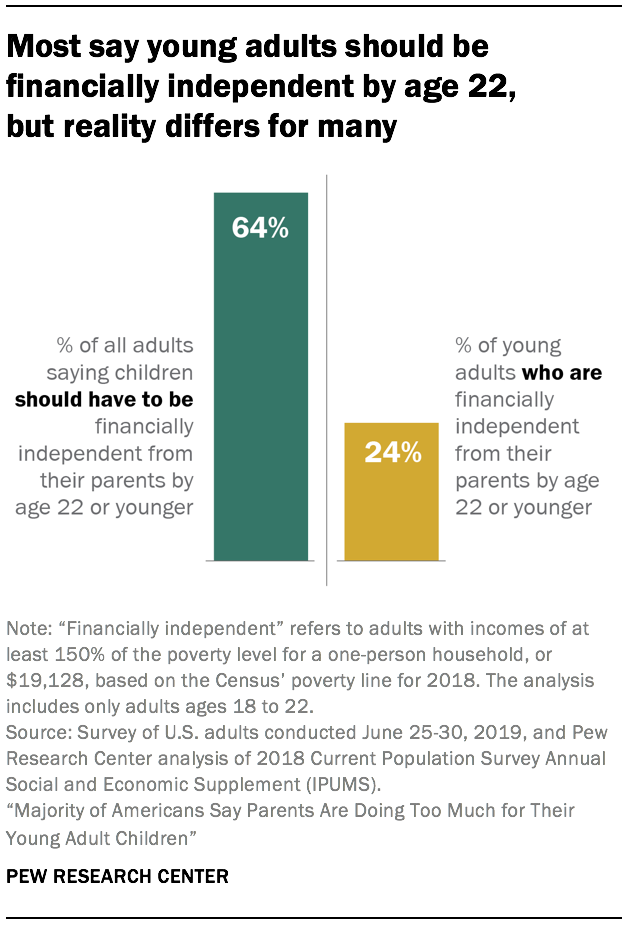

So, much to the dismay of my wallet, i set out to. If you live with your parents but want to become financially independent, put an end date on when you will move out. If your mounting debt is making it hard to become financially independent, there is a way to accept help from your parents wisely.

How to become financially independent — 4 tips. But my desire to be a fully independent adult motivated me to work toward separating my expenses from my parents’ bank account. 5 ways to become financially independent from your parents 1.

It helps to work toward a solid goal. Budget accordingly write down a list of everything you pay for currently, such as gas or eating out. When you get married, you’re going to have to go outside your marriage.

You need to get a job that pays well enough for you to pay all your own bills and expenses, including rent, your share of utilities (including internet and entertainment services such as. Ideally, you want to have at least three to six months’ worth of living expenses socked away, in cash, so that you don’t have to go knocking on your parents’ door if a disaster. Next, write down everything your parents pay for.

Stay on a budget that. Regardless of how much you earn, a budget helps ensure you avoid overspending. I recommend the following tips for those who want to be financially independent from their parents.

/financially-independent-56a635025f9b58b7d0e06933.jpg)