Out Of This World Info About How To Keep Track Of Mileage For Tax Purposes

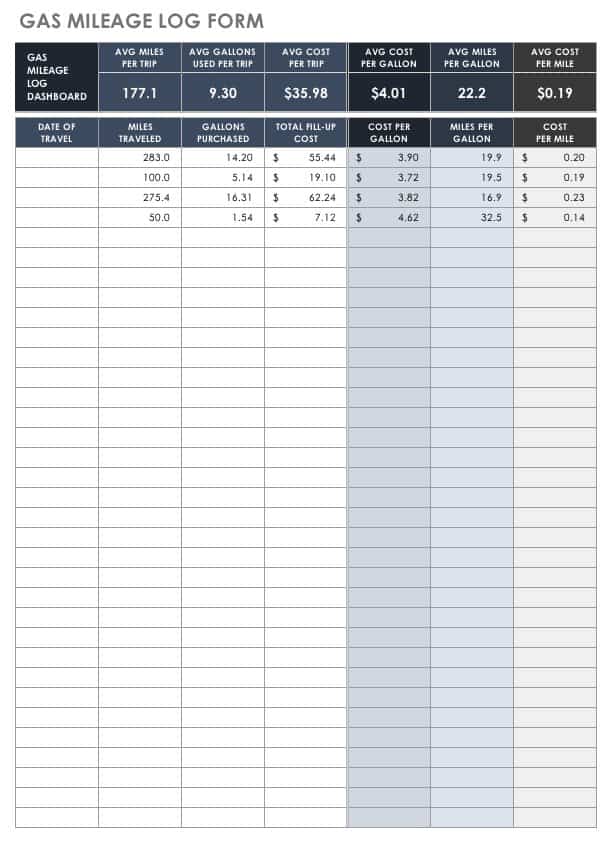

You need to record your ending odometer reading after the tax year.

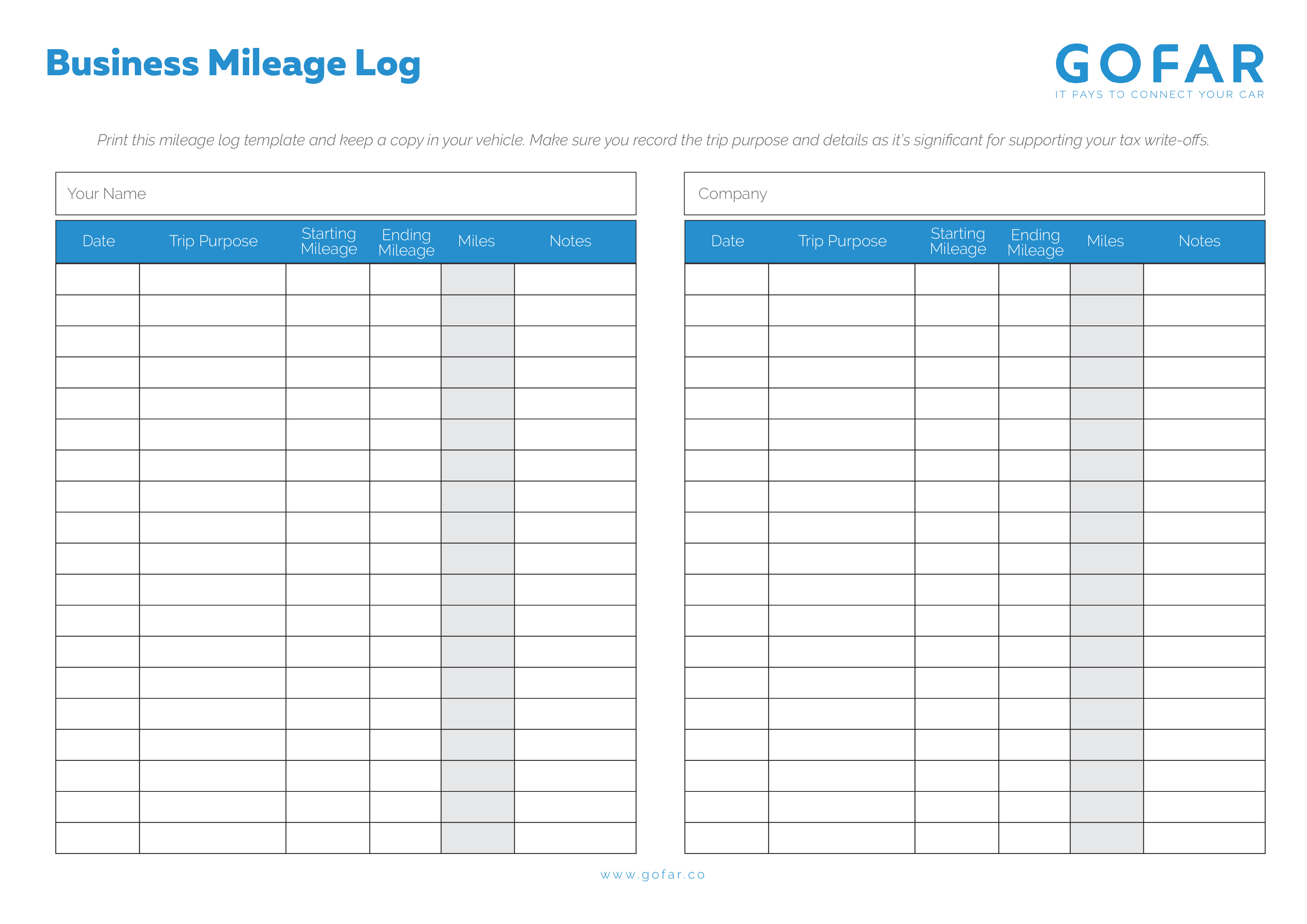

How to keep track of mileage for tax purposes. If your company has a. Most often, mileage tracking refers to keeping a mileage log for reimbursement or for tax deductions. To get started, create four columns.

The mileage for each business trip taken with your car; For tax purposes, the irs asks you to track: Once that pen gets lost the whole system breaks down.

However, it is integrated with the quickbooks self. When it comes to car expenses and tax deductions, there are two main methods you can use: Why keep an employee car mileage log.

Gas receipts are good, but remember, you have to show two things: Up to 25% cash back 7031 koll center pkwy, pleasanton, ca 94566. While having an acceptable mileage log for irs officials to refer to can help make filing simpler, you will want to keep the records on file in case they’re needed in the future.

Record your odometer at start of tax year · 4. The standard mileage method or the actual expenses method. Determine your method of calculation · 3.

Track odometer at the end of the tax year; The hardest way to track your mileage—and the way the irs would like you to do it—is to keep track of every mile you. It automatically tracks your miles (like mileiq).

![Forgot To Track Your Miles? We've Got You Covered [2020 Taxes]](https://blog.withpara.com/content/images/2021/04/abcdefg.png)