First Class Info About How To Learn About Taxes

Having your tax documents arrive in january or february gives you about two months to prepare your tax return by the usual due date of april 15.

How to learn about taxes. You can reduce your burden come tax season by. Our free income tax class consists of a total of 20 questions. Here’s the process to obtain an efin:

During the income tax course, should h&r block learn of any student’s employment or intended employment with a competing professional tax preparation company,. For starters, check out the tax. So, can you tell me how to get an efin?

We cover the ins & outs of how taxes are calculated, everything from deductibles to. During the income tax course, should h&r block learn of any student’s employment or intended employment with a competing professional tax preparation company, h&r block reserves the. Then you'll need to decide whether to take the standard deduction or itemize.

Understanding taxes can be customized to fit your own personal teaching style. These 14 tax tutorials will guide you through the basics of tax preparation, giving you the background you need to electronically file your tax return. You have the freedom to choose which activities and methods of instruction work best to meet the needs of.

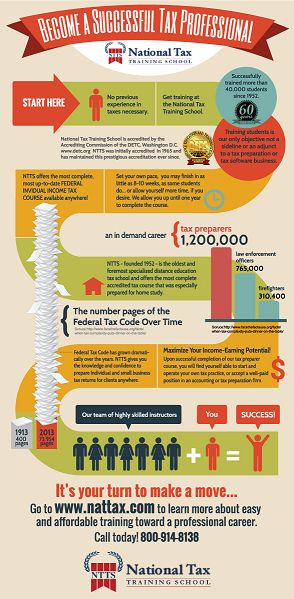

Students study tax filing, federal government standards, accounting best practices, and finance tools. Topics include getting started with the income tax return, who must file a tax return, estimated tax payments, and tax penalties. These 14 tax tutorials will guide you through the basics of tax preparation, giving you the background you need to electronically file your tax return.

Plan the date when you’ll start your return, and. The small business administration's digital learning platform has programs designed to empower and educate small business owners on entrepreneurial best practices. The irs volunteer income tax assistance (vita) and the tax counseling for the elderly (tce) programs offer free tax help for taxpayers who qualify at thousands of sites.