Fun Info About How To Lower Cost Of Capital

Web for example, if a company's preferred stock is trading at $80 with a quarterly dividend of $1, its cost of capital per year is 5 percent, or $4 divided by $80.

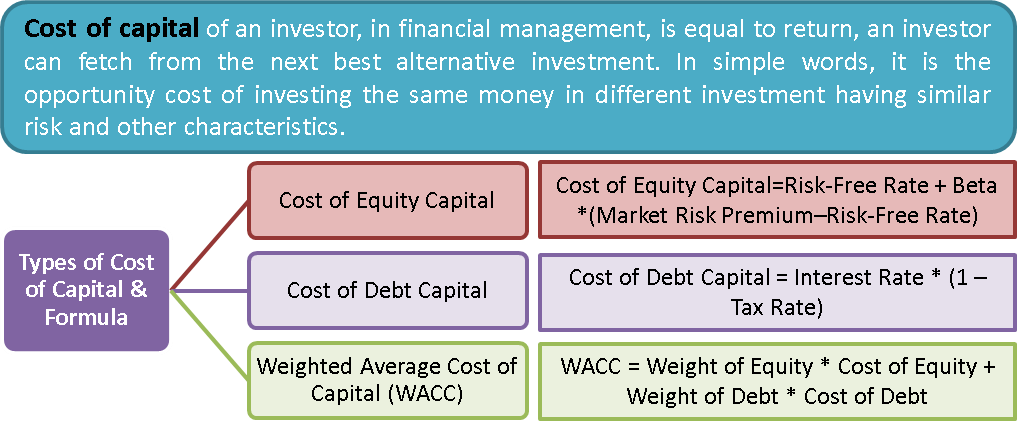

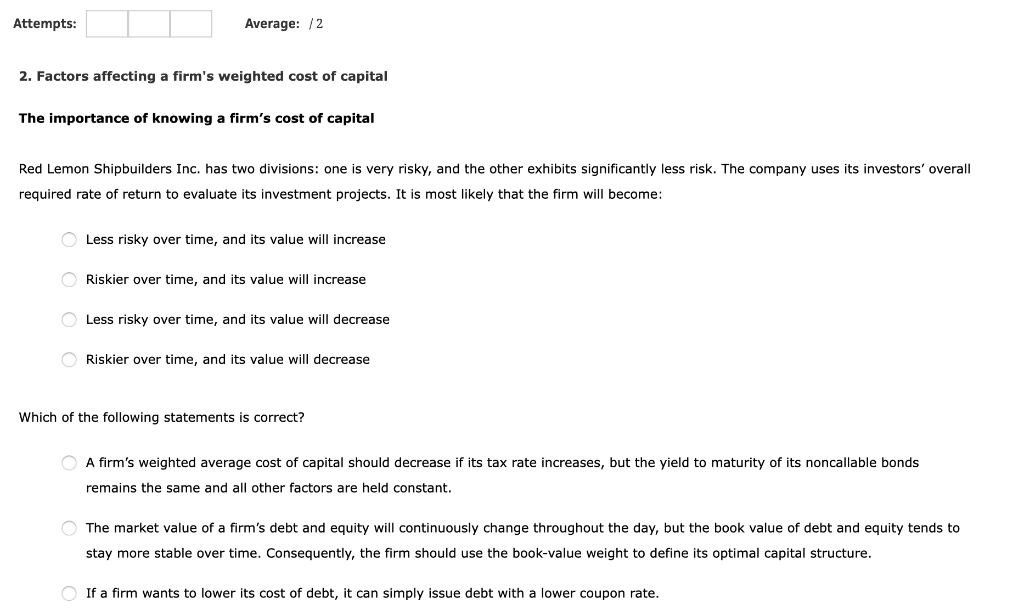

How to lower cost of capital. Web professor david hillier, university of strathclyde;short videos for students of my finance textbooks, corporate finance and fundamentals of corporate finance. Investors who buy stocks expect a particular rate of return. Cost of capital includes the cost of.

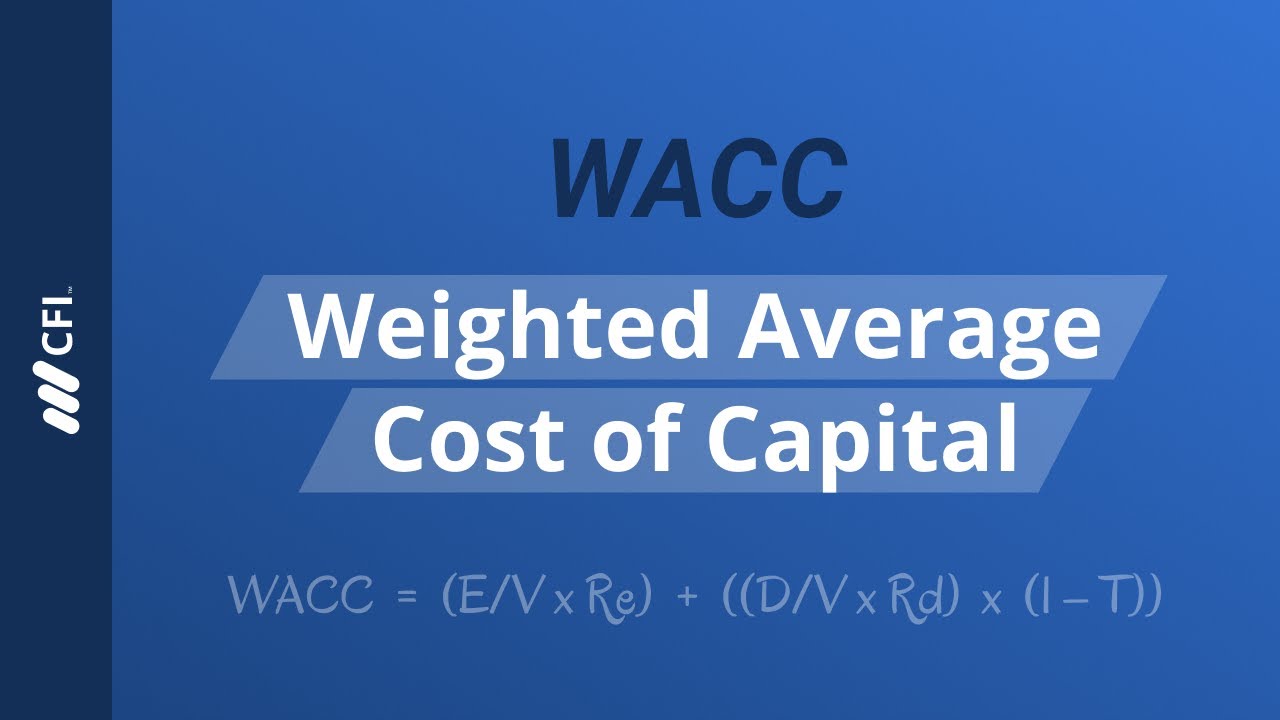

Web cost of capital is the required return necessary to make a capital budgeting project, such as building a new factory, worthwhile. After all, an investor wants to know what is going on in a. E = market value of the firm’s equity d = market value of the firm’s debt v = e + d r e = cost of equity r d = cost.

If the cost of common equity. Web giving up equity in exchange for cash is not the only way to fund your business. As your business matures, adding the right amount of debt into your capital.

Web you can either raise the whole round through equity, or you can raise $500,000 through an equity raise where you sell with 5% and the other $500,000 through an sr&ed tax credit. Web you can reduce your firm’s cost of capital by actively managing its environmental risks, for example, by choosing strategic investments that reduce. Equity cost is the return on investments that shareholders expect to earn from the company.

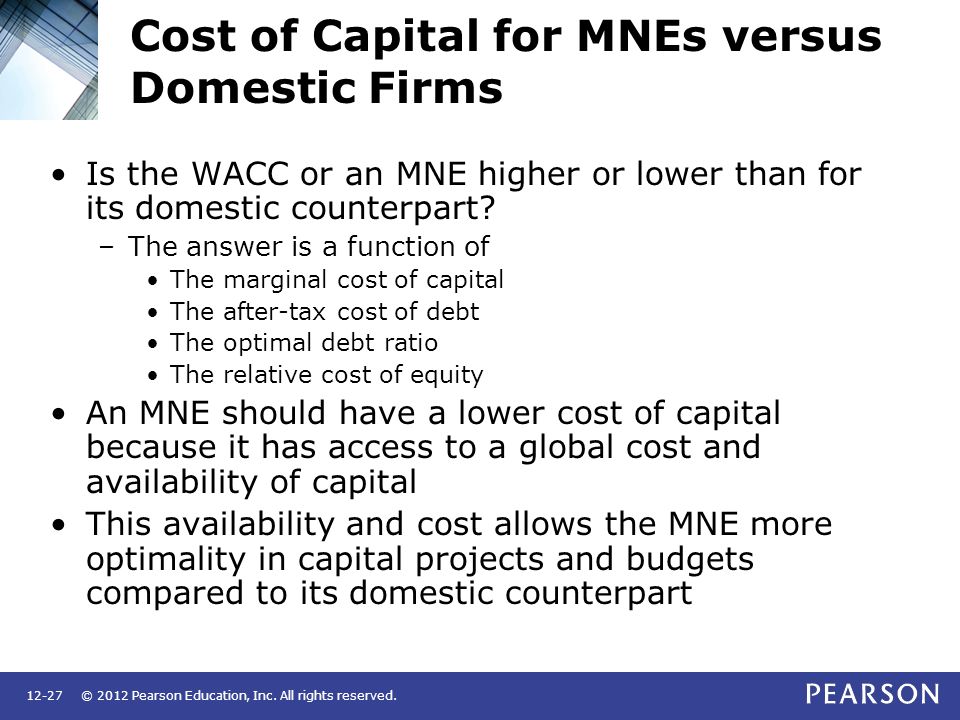

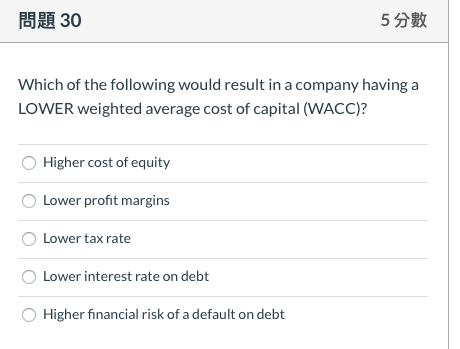

Specifically, to buy the stock, they. Web however, on the cost of capital side, it makes sense that companies that disclose more data have lower costs of capital. Web how can a company lower its weighted average cost of capital?

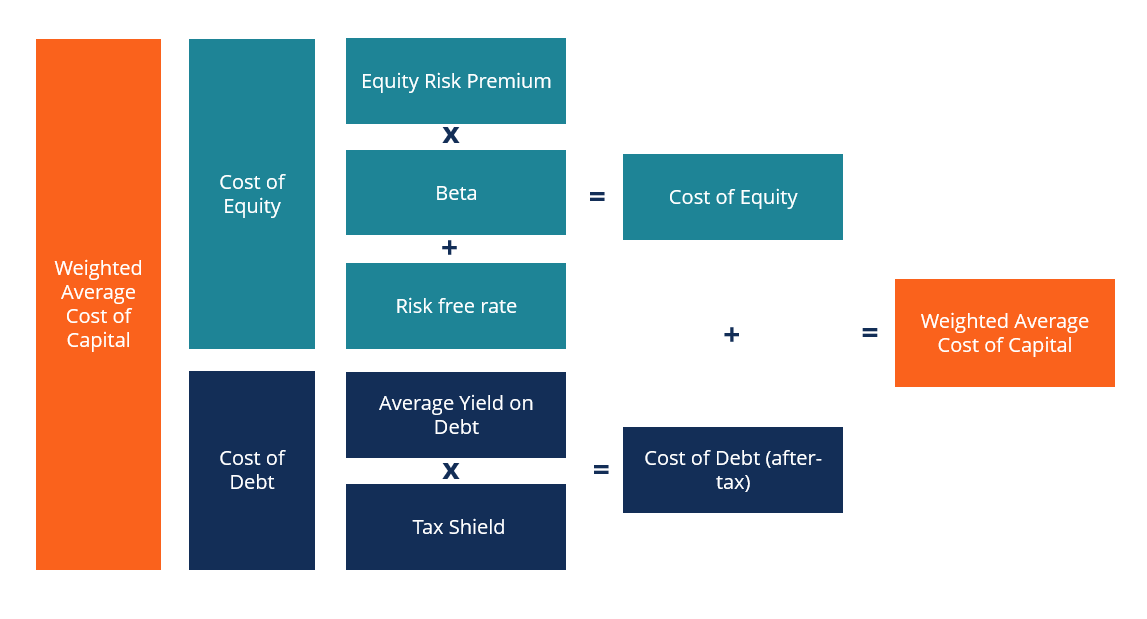

Web ignoring the debt component and its cost is essential to calculate the company’s unlevered cost of capital, even though the company may actually have debt. The required rate of return is the return premium required. Web wacc = ( e v × r e ) + ( d v × r d × ( 1 − t c ) ) where:

/COST-OF-CAPITAL-FINAL-HR-f3d41d21c66a494ea77eec360a6a3857.jpg)