Underrated Ideas Of Info About How To Reduce Credit Card Apr

How to lower your credit card interest rate 1.

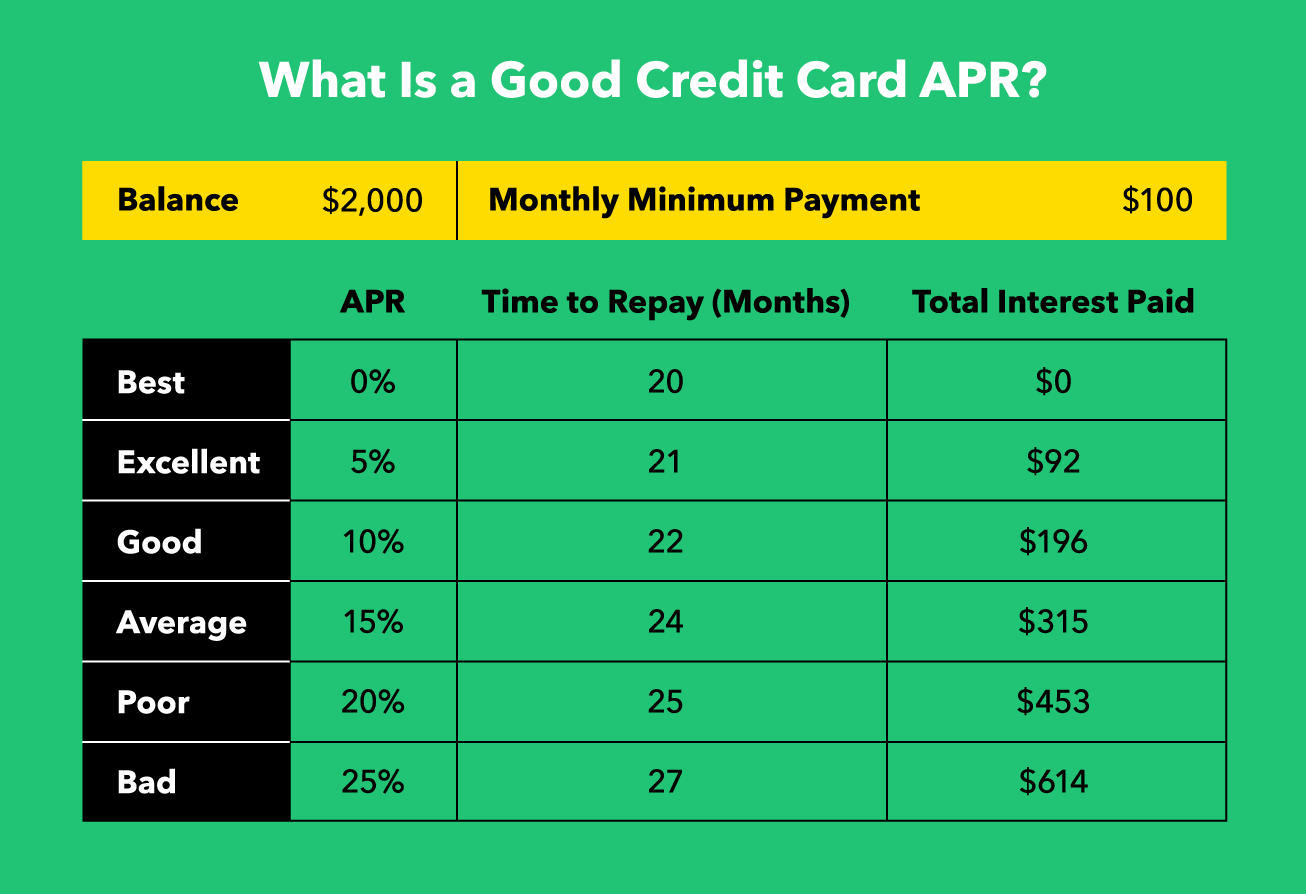

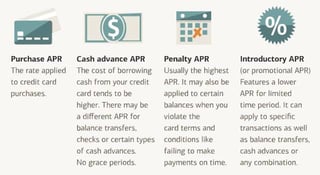

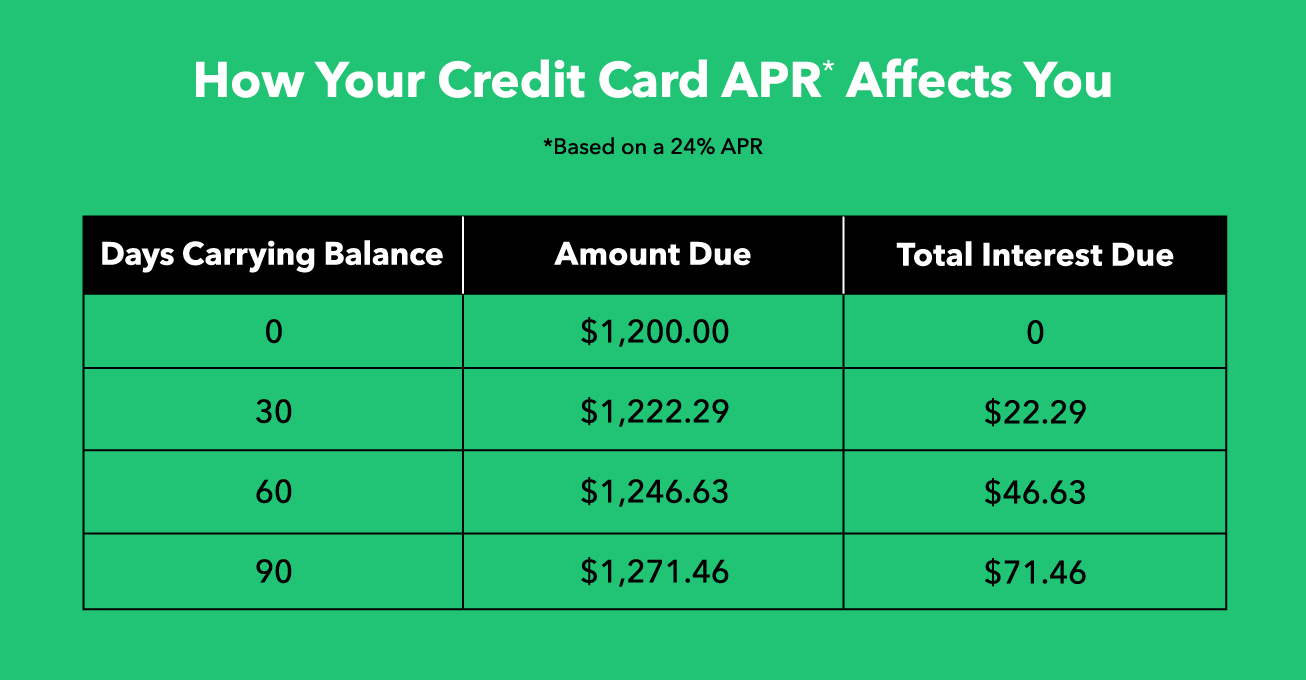

How to reduce credit card apr. Sometimes a bank would need to ensure. However, even if you have a good fico score you need to read the fine print of your credit card agreement. Your credit card company won't lower your apr just because you've been taking.

So, that’s exactly half of your payment that’s used to cover. Your credit card company most. Credit card company won’t lower apr rates.

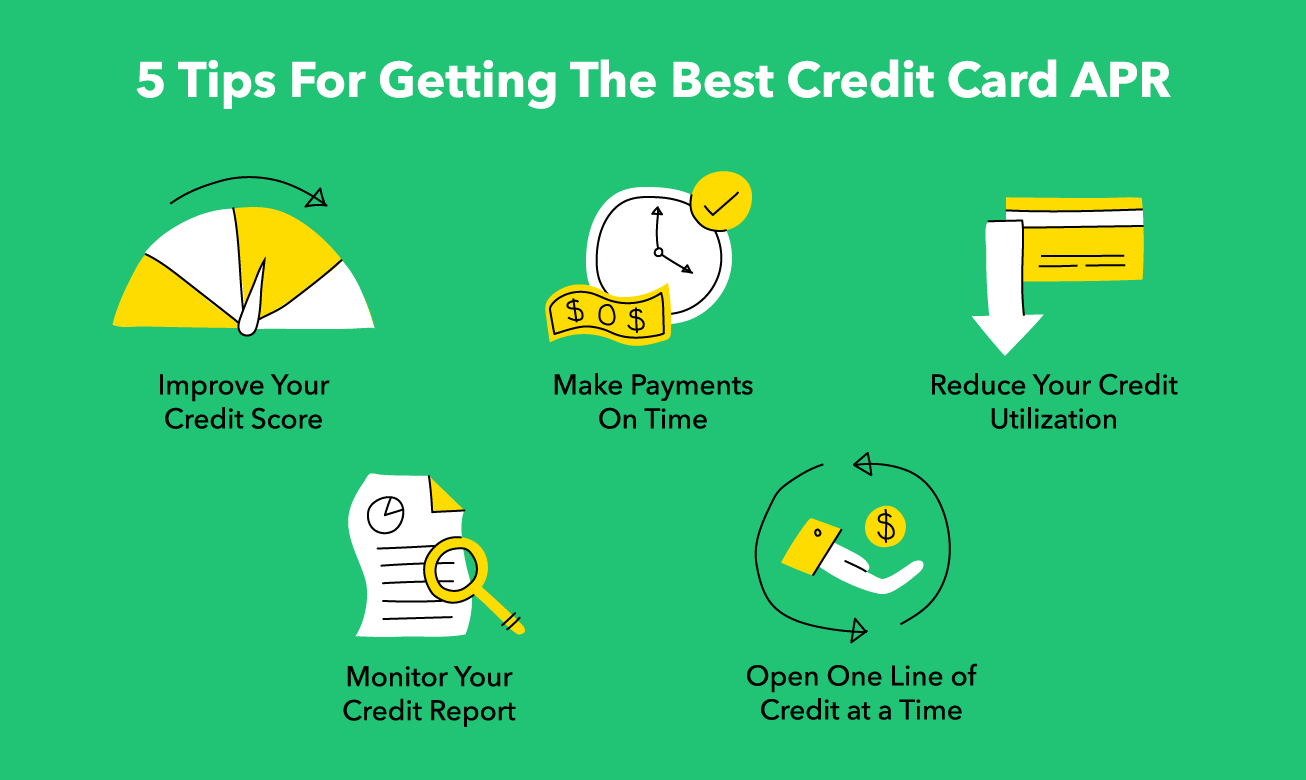

You can possibly lower your credit card's interest rate by doing research, contacting your card issuer and requesting a lower apr. 1 day agoonce you’ve applied, the steps are as follows: Choose a chase credit card for the balance transfer.

You also avoid late fees and late payments,. By avoiding cash advances and paying off your credit card in a timely fashion, you can keep your credit utilization rate lower, improving your score. New york ( mainstreet) — credit card interest rates are climbing high again.

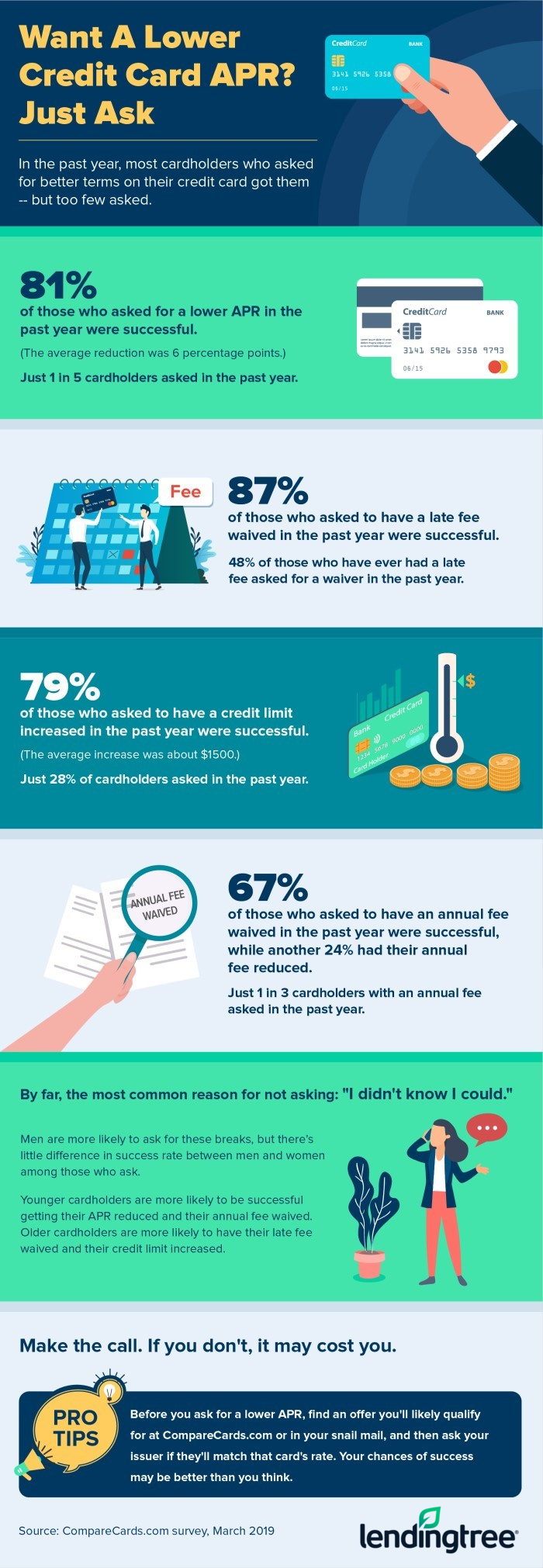

Yes, part of the secret to a lower credit card apr is asking, but the bigger secret is persistence. You need to talk with someone who can lower your apr and waive the annual fee. For credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate or, with the right account, provide a few months of.

How to ask your credit card provider for a lower interest rate call your card provider: However, be prepared for the representative’s. Your best path forward will depend on your monthly.