Awesome Info About How To Reduce Earned Income

For those who are eligible, the foreign earned income exclusion (feie), entitles them.

How to reduce earned income. Contribute to a retirement account retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost. 12 ways to lower your taxable income this year 1. If you earn more than $50,520 ($51,960 for 2022) it deducts $1 for every $3 you earn—but only during the months before you reach full retirement age.

7 once you reach full. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. 4 ways to reduce taxes on foreign earned income foreign earned income exclusion.

The eitc is generally available to workers without qualifying children who are at least 19 years old with earned income below $21,430 for those filing single and $27,380 for. While you may have heard that nothing is certain but death and taxes, it is possible to reduce your us taxes to nearly zero, even when you're paid a salary. No you cannot reduce your income in order to qualify for eic.

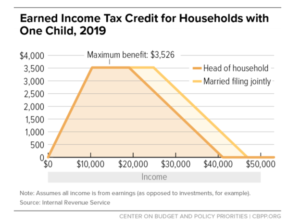

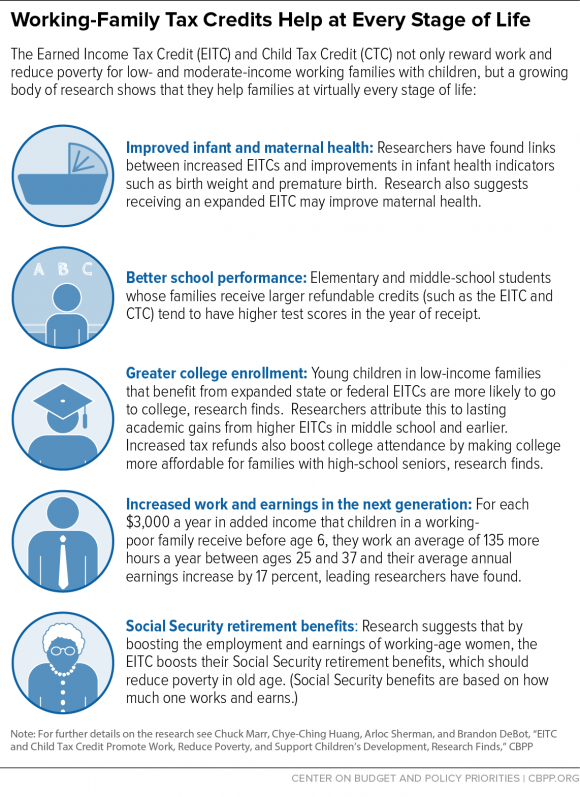

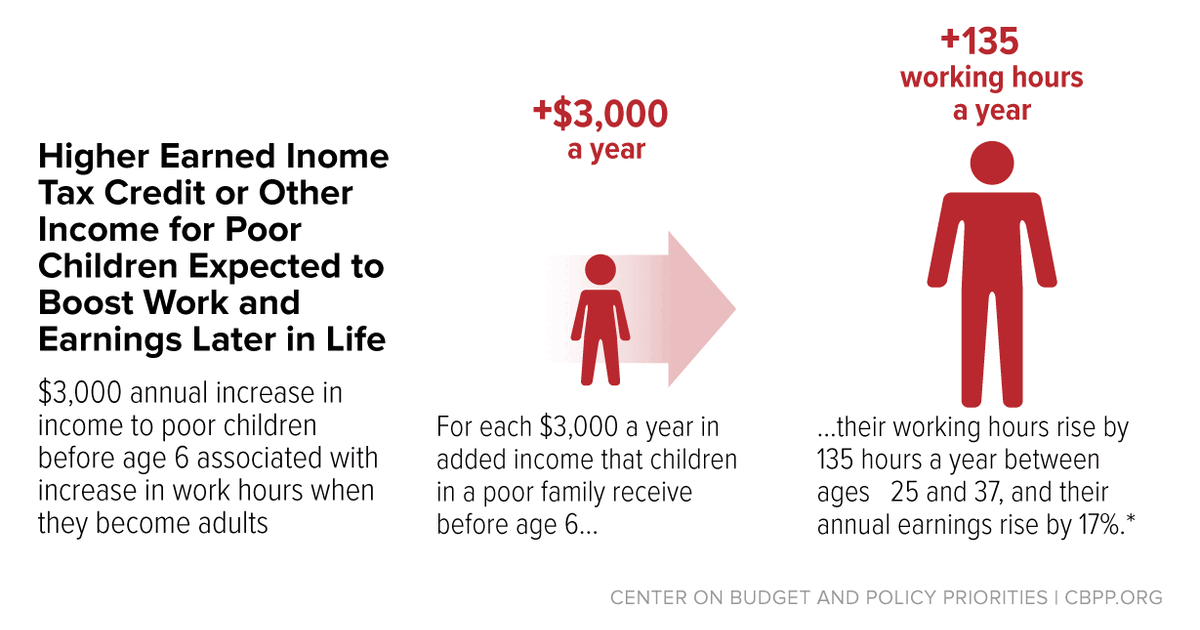

Your employer pays half this tax. Nationwide during 2019, 25 million eligible workers and families received about $63. The eitc is a federal tax credit that offers hardworking american workers and families a financial leg up.

It was introduced as an opportunity to lower poverty and. First, 12.4% of your earned income is paid to social security. Maximize contributions to your retirement plan.

Pay the extra taxes so it’s considered earned income. The money you put into your retirement fund isn’t taxable and,. If it is any comfort, when you are right on the edge of qualifying for eic, the eic amount you could receive would be very little.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)